1099 paycheck calculator

Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Give your employees and contractors W-2 and 1099 forms so they can do their taxes.

Flyfin Unveils Free 1099 Tax Calculator To Help Filers With Self Employment Tax Financial It

Then enter the employees gross salary amount.

. 1 You Can Make Sure Youre Having Enough Withheld. Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying. February 1 Due Date to IRS.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Its the contractors responsibility to report their income and pay their taxes. 2 Guide to Using the Withholding Calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The steps our calculator uses to figure out each employees paycheck are pretty simple but there are a lot of them. Stub creator provides best calculator to calculate in hand salary for hourly and salaried employees on its free salary paycheck calculator tool.

IRS Federal Taxes Withheld Through Your Paychecks. IRS Federal Taxes Withheld Through Your Paychecks. This calculator is useful for waiters waitresses servers bartenders restaurant ownersmanagers and other gratuity or tip-based careers where earned tips are reported as wages.

PAYucator - Paycheck W-4 Calculator. So at the end of the year youll send them a 1099-NEC tax form. Exempt means the employee does not receive overtime pay.

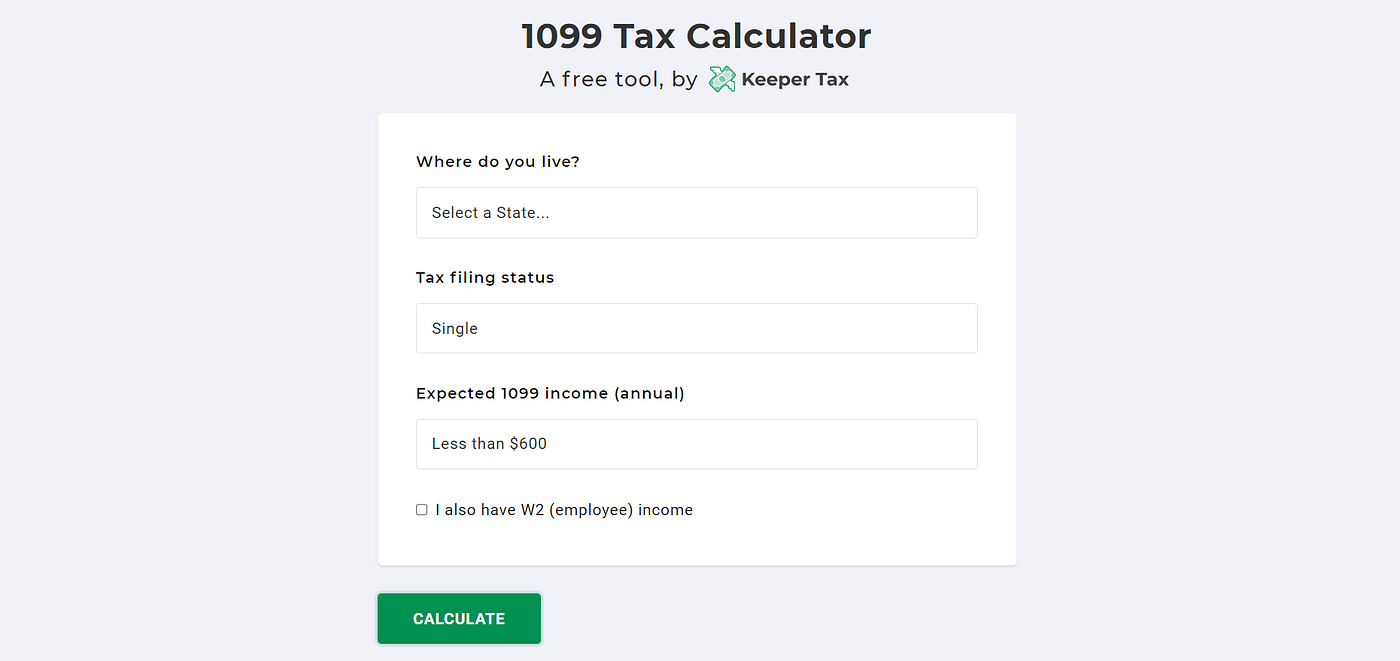

You can prepare form 941 W-2 1099-misc and others one at a time online or upload a data file to file by the thousands. Load and Complete the Forms Before You Mail Them to the IRS. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. This Tax Calculator Lets You Estimate Your Taxes. ESmart Payroll has been providing IRS authorized payroll e-file since 2000.

You will want to prepare new W-4s for all your jobs following the instructions or use the IRS online calculator. Fields notated with are required. 3 A Special Note on the Withholding Calculator.

Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. 4 How to Change Your Withholding Amount. 5 How to File Taxes Online in 3 Simple Steps - TurboTax Tax Tip Video.

Simple Payroll is a full service online payroll where we will make tax deposits and file payroll reports for you. And local W4 information into this free Massachusetts paycheck calculator. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Number of 1099 contractors. Box 1 of your 1099-Q will report the total distribution from your education program for the year regardless of whether the funds are sent directly to the school.

The employer family leave percentage. When your mutual fund makes a distribution of its investment earnings to you and reports it in box 2a of Form 1099-DIV the IRS generally allows you to treat the distribution like a long-term capital gainThis is beneficial since the same tax rules that apply to your qualified dividends also apply to mutual fund capital gain distributions regardless. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details. Form 1099-G Certain Government Payments. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

Prepare print and file form 941 940 944 W-2 W-2C 1099-misc correction and convert California DE9C ICESA MMREF to XML etc. Switch to Massachusetts hourly calculator. Generally you only list your children on the job with highest income look carefully at step 3 of the form also make sure you either use the online calculator or check the box for married with 2 jobs in step 2.

Input the tip amount hourly rate number of hours pay period and other details into our Tip Tax Calculator to see what your paycheck should be. Massachusetts Hourly Paycheck Calculator. Heres how it.

Box 2 reports the portion of the distribution that represents account earnings while Box 3 reports the portion representing the original contribution to the account. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. The 2019 Calculator Help You Complete Your 2019 IRS Paper Tax Forms.

Continue if you wish to make adjustments to your Tax Withholding on your W-4 and see how this would affect your Paychecks and your 2019 Tax Return. W-4 Pro Select Tax Year 2022. Users can prepare.

PPP Loan Calculator. 2021 2022 Paycheck and W-4 Check Calculator. W-4 Adjust - Create A W-4 Tax Return based.

RATEucator - Income Brackets Rates. Easy to use quick way to create your paycheck stubs. Employees can calculate their net pay or take home pay by entering pay period YTD hourly and annual salary rate.

Use this calculator to view the numbers side by side and compare your take home income. A 1099-NEC lists how much money an independent contractor earned so they can pay taxes on that income. W-4 Check - Paycheck Based W-4 Form.

Due Date to Recipient. Form 1099-G Certain Government Payments. SBAs table of small business size standards helps small businesses assess their business size.

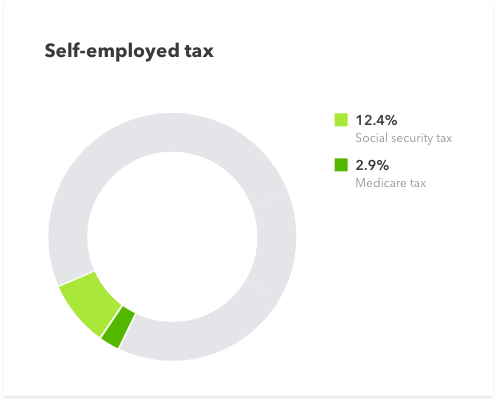

W2manager is designed for organizations that need to prepare and file many W-2s. The employer medical leave percentage. For reporting nonemployee compensation such as income earned as an independent contractor freelancer or self-employed individual.

As a W2 employee you have the convenience of receiving a regular paycheck and employer-provided benefits without having to. Estimate in 2022 and e-File in 2023. A 1099 employee doesnt receive benefits or have taxes deducted from their paycheck.

Make Paycheck Stub online and free yourself from the worries of hiring an individual to manage your financial details for you. 2017-2020 Lifetime Technology Inc. Worked as a rideshare driver food delivery person freelance writer or other gig worker or independent.

Number of 1099 contractors. 2022 Tax Calculator Estimator - W-4-Pro. Choose your state below to find a state-specific payroll calculator check 2022 tax rates and other local information.

2021 Tax Calculator to Estimate Your 2022 Tax Refund. Paycheck Protection Program PPP Loan Calculator For. Table of Contents.

Use our free check stub maker with calculator to generate pay stubs online instantly. Form 1099-DIV Dividends and Distributions. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Mutual fund distributions.

Self Employed Tax Calculator Best Sale 58 Off Www Wtashows Com

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Tax Calculator For Self Employed Sale 59 Off Www Wtashows Com

Tax Calculator For Self Employed Clearance 58 Off Www Wtashows Com

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Calculator For Self Employed Sale 59 Off Www Wtashows Com

Flyfin Unveils Free 1099 Tax Calculator To Help Filers With Self Employment Tax

Form 1099 Nec For Nonemployee Compensation H R Block

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Flyfin Offers Free 1099 Tax Calculator To Help With Self Employment Tax

Self Employed Tax Calculator Factory Sale 60 Off Www Wtashows Com

Estimated Tax Payments For Independent Contractors A Complete Guide

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Flyfin Unveils Free 1099 Tax Calculator To Help Filers With Self Employment Tax

Top 8 Freelance Tax Calculators To Help You Save The Most Freelancer S Handbook